This is advice for young people to avoid the worries that debt can create in their future. The concepts are simple, and the only complication is being disciplined. And if you are a parent, pass these recommendations along to those you love.

When I was a 12-year-old kid way back in 1962, my favorite treat was a Hostess Cup Cake, that chocolatey, icing-covered, cream-filled cake with the white twirls on top. I would slowly eat the icing on the cake’s circumference, then save the biggest creme-filled bite for last! I didn’t enjoy it very often because money was tight. Back then, a Hostess Cup Cake only cost 12 cents, but that equates to $1.26 in today’s inflated dollars. My mother’s waitress’s income was not sufficient to raise six children, let alone spend it on frivolous items like cupcakes times six children!

Today, I find Hostess Cup Cakes cost as much as $2.50! That’s double what inflation would explain. However, this tasty treat has been replaced by others; and although I can now afford them, the price seems high (with my knowledge of seemingly cheaper times) helping me avoid the temptation. But financially, buying a $5 chocolate chip cookie or cinnamon roll is a non-issue for me. I can buy them without financial guilt, only caloric shame.

Understanding the Value of Money

Where am I going with this? The cost of items you may desire should not be measured in dollars alone, but in the alternative uses of that dollar, AND the percentage of dollars you have available to spend on any purchase.

Think of dollars as water. The deeper the water, the more money you have. If your money is a small puddle, then removing a cupful will be noticed. If, on the other hand, you have a swimming pool of money, you could remove 100 bucketfuls and not notice the loss. Those are the extremes to illustrate the example of water as money.

My mother barely had a puddle of water in terms of money. Even removing spoonful would be noticed, and if not used to relieve debt or feed her children – it would be misspent. I, in turn, escaped the turmoil of my youth, and performed simple but important acts to build wealth, i.e. a deeper pool of money. Here’s how.

Lifestyle Choices and Financial Discipline

According to a study by the Brookings Institute, in order to not be poor takes three simple acts:

- Finish High School.

- Get a full-time job.

- Wait until age 21 to marry and have children.

My mother did none of these steps, and worse, she married at 16 years of age to a man nine years her senior, who decided not to take care of his family. On the other hand, I unknowingly followed the advice of the Brookings study and went even further.

- I not only finished High School, but received a scholarship, due in part to my financial need, receiving a college degree.

- I joined the US Air Force right after college. A full-time job.

- I didn’t marry or have children, until I was 25 years of age.

I was now able to build wealth or deepen my pool of water (assets) towards a large bucket of water from a puddle. But I didn’t have wealth immediately. I could have spent every dime on a decent home, a few essentials, and fun; but my bucket of money would have remained only a bucket.

Creating Wealth

To save money and create wealth requires taking and being faithful to these actions.

- Know where your money is going. Have a budget and stick to it.

- Make saving any amount a priority. The more, the better!

- Save using automatic transfers to an interest bearing account or investment. You won’t miss it if you never see it.

- Find ways to increase your income through working smartly and education.

- Be disciplined. Have fun for sure! But be wise.

Parental Guidance and Support

Parents play a crucial role in shaping their children's financial habits. Here are a few ways parents can support their teens in becoming debt-free:

- Lead by Example: Demonstrate responsible financial behavior and share your experiences and lessons learned.

- Encourage Open Discussions: about money matters, budgeting, and financial goals.

- Provide Resources: Offer books, articles, and online resources that teach financial literacy.

- Set Up Savings Accounts: Help your teens set up savings accounts and guide them in managing their finances.

Conclusion

Being debt-free starts with making informed and disciplined financial decisions from a young age. By understanding the value of money, building a strong financial foundation, and adopting practical steps to save and invest, teenagers and young adults can pave the way for a financially secure future. Parents can play a vital role in guiding and supporting their children on this journey. Remember, financial freedom is not about having a large income but managing the income you have wisely. Start early, stay disciplined, and enjoy the peace of mind that comes with being debt-free.

I’m not ‘yacht’ wealthy, but I am ‘new car’ wealthy, meaning I can’t but a yacht. That would empty my modest but sufficient pool of water (wealth). But I could buy a new car and not be in financial trouble. And most of us can reach a ‘new car’ level of wealth without being super-smart or a talented entrepreneur. Assuming you are healthy and loved, there is no better feeling than being debt-free!

Michael Byron Smith

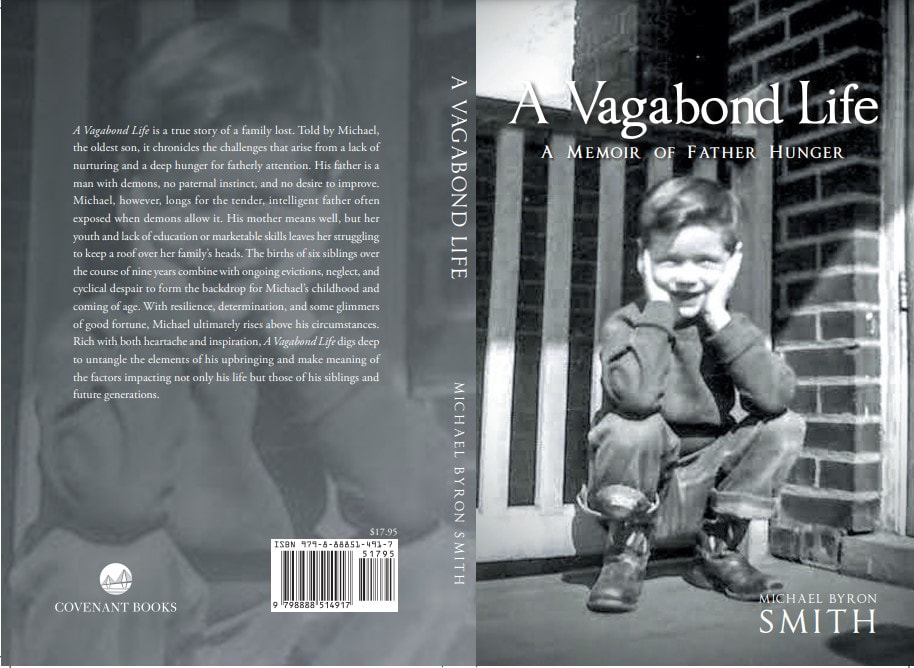

Note: To read more about my childhood and escape, read my book; A Vagabond Life: A Memoir of Father Hunger (#avagabondlife).

To learn about the power of being a father, read my book; The Power of Dadhood: How to Become the Father Your Child Needs (#powerofdadhood).